The data on this page are for use by both former Kaplan University and current/future Purdue Global students. Purdue University acquired Kaplan University in March 2018 and created Purdue Global.

1. What is Form 1098-T (Tuition Payments Statement)?

Purdue Global is required by the IRS (26 CFR 1.65050S-1) to send Form 1098-T to students who had payments made to their account for qualified tuition and related fees during the calendar year 2024. The form is used to assist the IRS and students in determining qualifications for education-related tax benefits.

2. Will I receive a 1098-T form this year?

If Purdue Global received payments or issued reimbursements toward your account for qualified tuition and related fees during 2024, you should receive a 1098-T form. There are a couple of exceptions to note:

- If all payments received were grants/scholarships, no form is generated, and

- If all payments received were refunded or returned as stipends, no form is generated.

3. When will I receive my 1098-T form?

The IRS deadline for mailing 1098-T forms is January 31. If this date falls on a Saturday, Sunday, or legal holiday, the form is considered timely if filed or furnished on the next business day. The information on Form 1098-T was prepared by Purdue Global using the financial information and address as it appears in the student information system. If you have moved in the past year, please verify your address with the business office.

4. Can I access my 1098-T form electronically?

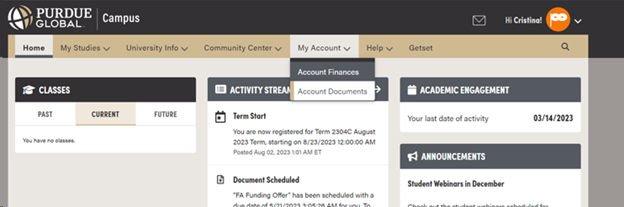

Beginning with tax year 2023, an electronic copy of Form 1098-T is available on the student portal in PG Campus. You can log in at https://campus.purdueglobal.edu. To access the document, click My Account then Account Documents.

Form 1098-T will be listed in the third section (after Document History), under 1098-T Documents. This is a downloadable PDF document. Please note that a physical copy is also mailed to the address on file in the student information system.

5. If I receive Form 1098-T, does that mean that I qualify for the Hope Scholarship, Lifetime Learning Credits, or other tax benefits?

Not necessarily. Please consult with the Internal Revenue Service (IRS) or a qualified tax professional to address any tax related questions. Purdue Global is unable to dispense tax advice or determine tax benefit qualifications.

6. If I am a nonresident alien, will I receive a Form 1098-T?

Institutions are not required to file Form 1098-T with the IRS for nonresident aliens, but Purdue Global will gladly provide the form to the student upon request. Please contact the 1098-T Help Desk (below) for such requests.

7. What do the amounts located on the form represent?

- Box 1 represents the amount of payments received for qualified tuition and related fees from any source during 2024. The amount reported is the total amount of payments received less any reimbursements or refunds made during 2024.

- Box 4 represents the amount of reimbursements or refunds made during 2024 that relate to payments reported in prior years.

- Box 5 represents the total amount of scholarships and/or grants that were processed during 2024 for qualified tuition and related fees.

- Box 6 represents the amount of reimbursements or refunds made during 2024 that relate to scholarships and/or grants reported in prior years.

- Box 8 is checked if you were at least a half-time student (6 credit hours and above) for one or more academic period(s) that began during the calendar year of 2024.

- Box 9 is checked if you were enrolled in a graduate-level program during 2024.

8. Why does the 1098-T form show payments instead of amounts billed?

Eligible educational institutions can no longer choose to report payments received or amounts billed for qualified tuition and related fees. Beginning in 2018, per the IRS, only the qualified tuition and related expenses actually paid can be reported on Form 1098-T.

9. What if I didn't get a 1098-T? What if the information on my 1098-T is incorrect?

If you were enrolled in courses during the 2024 calendar year and made payments or had reimbursements/refunds issued for qualified tuition and related fees but did not receive a form, please verify your address on file with the business office. If your form was mailed to a former address or you have questions regarding your forms information, please contact the 1098-T Help Desk (below).